Version 6 of Spectrum Omega is here! I’ve been working on this since May, lots of late nights and early mornings.

The biggest improvement is three new maps!

- County-level Ownership Maps!

- County-level Operator Maps!

- Depth Charts!

The other major change is the terms and conditions of use for the site. Spectrum Omega will remain free for personal use, and the two existing maps (Licensed Area Ownership and Operator-specific maps) will remain free for all, including those who use this website for business or commercial purposes.

If you use this website for business or commercial purposes, you will need to purchase an annual subscription to use the new County-level Ownership and Operator maps, along with the Depth Charts. These changes take effect December 1, 2020.

Be sure to contact me if you notice anything odd or have any questions!

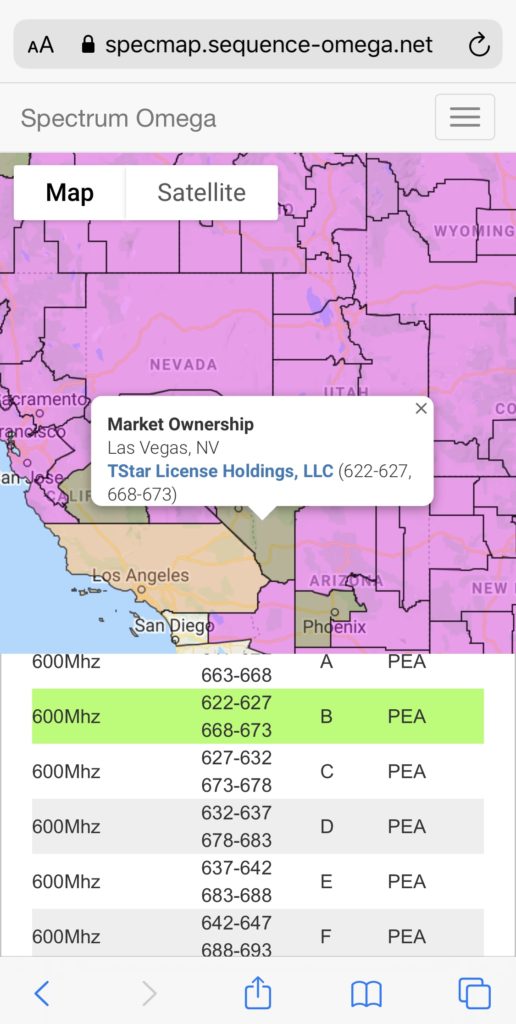

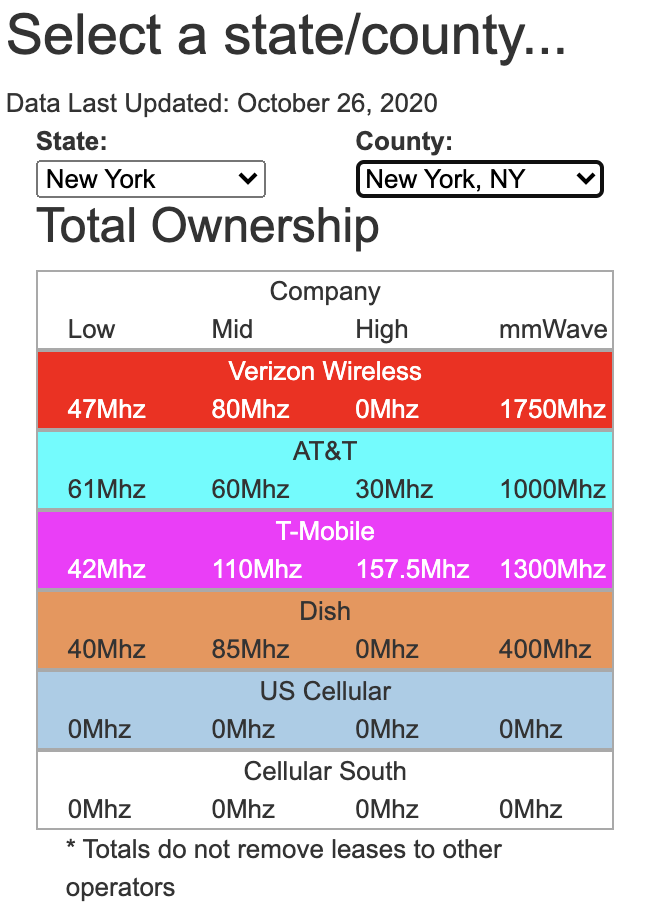

County-level Ownership Maps

License ownership is now shown at the county level, this is very helpful in areas where two or three or four different operators share ownership of a licensed area, or where a licensed area is very large.

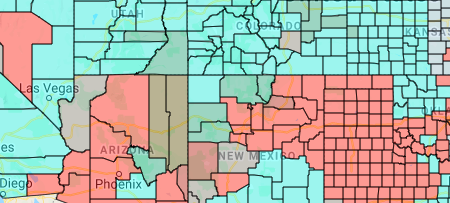

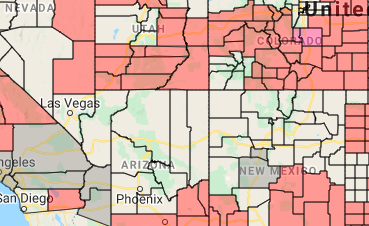

County-level Operator Maps

This map focuses down to one operator the counties in which they own licenses. The different shading of the county may indicate other operators own spectrum in these counties as well.

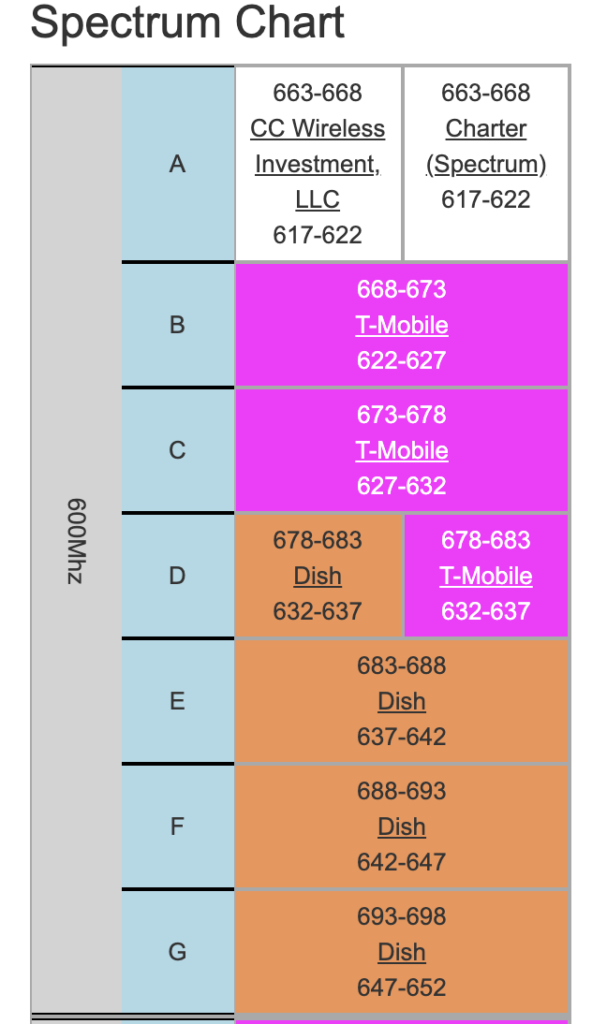

Depth Chart

Depth charts are used to examine the ownership of all spectrum, from 600MHz to mmWave, in just one county. This can be used to asses how much a particular operator owns in that county. You can click the operator name to take you to the FCC ULS page for that license. At the top is a summary of ownership totals but those total aren’t weighted for population when a county is split, nor are leased licenses removed from the total.

For the spectrum summary, “Low” is spectrum ownership below 1 GHz, “Mid” is between 1.0-2.3 Ghz, “High” is between 2.3-6.0 GHz and mmWave is anything above that (technically 6+ GHz isn’t mmWave but I’ll come back and adjust this if we start using Ku band for cellular phones).